- Fortunafi's Real World Insights

- Posts

- RWA & Stablecoins: 10 Predictions for 2023

RWA & Stablecoins: 10 Predictions for 2023

New year, new predictions for what 2023 holds.

After a tumultuous 2022, market participants have been looking forward to turning a new leaf and shifting focus to a new year with new possibilities. Despite the collapse of industry juggernauts, such as Three Arrows Capital and FTX, having weighed on both cryptoasset prices and sentiment, innovation and development have yet to come to a grinding halt. As with prior crypto market cycles, the 2022 bear market is believed to have reset expectations and positioned the industry for new, widely unexpected developments that will serve as a stepping stone for mass adoption in the years ahead. Consider that after cryptoassets bottomed in 2018, the Decentralized Finance (DeFi) sector began gaining momentum, resulting in hyperbolic growth throughout 2021.

With the cryptoasset industry having a tendency to abruptly shift focus upon a sector making meaningful progress and/or experiencing a jump in momentum, it’s worthwhile to consider the broader trend. Coupling such reality along with the fact that stablecoins and Real World Assets (RWA) remain, in our eyes, the next big drivers of crypto adoption, we’ve compiled ten predictions for 2023 that lend insight into where both sectors are headed and why.

After reading this report, you can expect to understand better why stablecoins and RWA will explode in 2023, as well as the broader macro trend for both industries. As we see it, stablecoins and RWA are sleeping giants, and 2023 is the year that puts both on a path toward unprecedented mass adoption.

Prediction #1: RWA TVL Will Surpass $1B, Centrifuge Will Surpass $500M TVL

Fig. 1: RWA TVL vs. Projected TVL

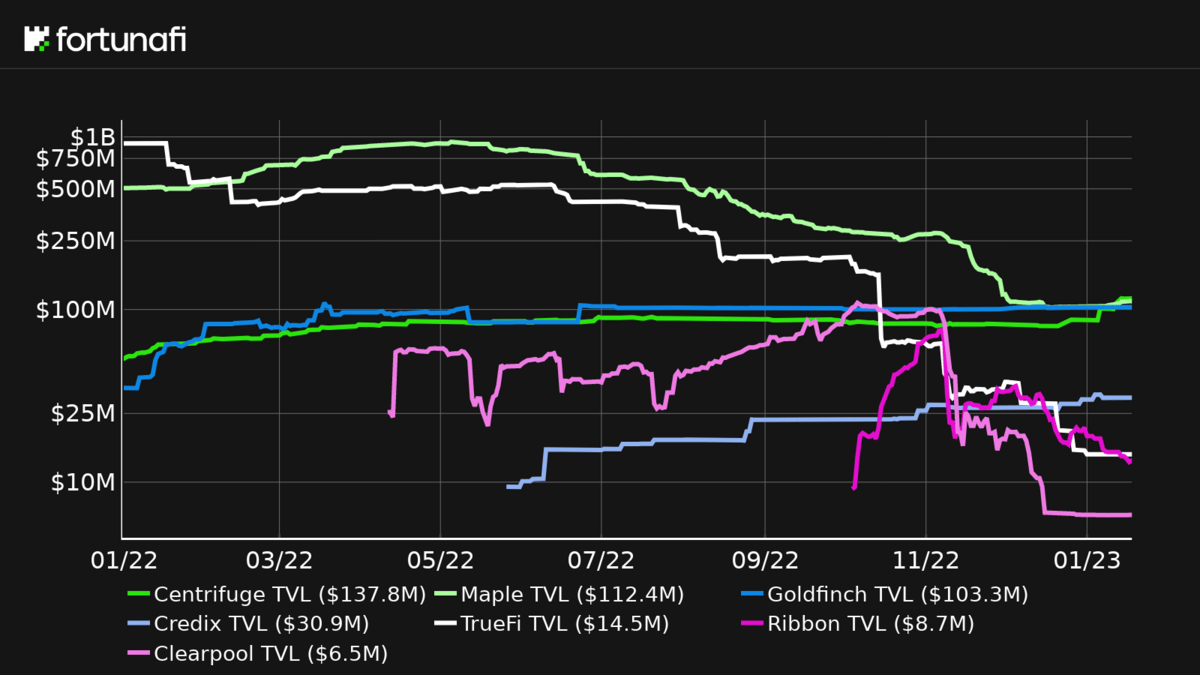

Although it isn’t until 2024 that we expect RWA total valued locked (TVL) to hit new all-time highs, we believe that emerging industry participants, new RWA solutions, and growing interest from individuals, institutions, and DAOs will catapult RWA TVL from nearly $400M to $1B in 2023. Additionally, we predict Centrifuge to be the largest RWA protocol and surpass $500M in TVL as new and existing industry players integrate into Centrifuge’s Tinlake platform.

Fig. 2: TVL by Protocol

Prediction #2: RWA-To-DeFi Ratio to Hit an All-Time High

Staying true to our belief that RWA will see meaningful adoption in 2023 for many reasons, we expect that the RWA-to-DeFi ratio, which compares RWA TVL to DeFi TVL, will return to previous all-time high. In particular, RWA will continue to command an increasingly greater market share due to investors, institutional investors, and DAOs ramping up their exposure to RWA. For instance, in December 2022, BlockTower Credit and MakerDAO pooled together $220M to launch several RWA pools on Centrifuge.¹ We expect this ratio to trend higher due to the growing demand for stablecoin issuers to use RWA as collateral.

Fig. 3: RWA-to-DeFi TVL Ratio vs. Projected Ratio

Prediction #3: Uncollateralized Lending as a Percentage of RWA TVL to Fall to 25%

While we expect collateralized lending solutions and RWA-backed stablecoins to drive meaningful growth in RWA TVL, uncollateralized lending protocols will command an increasingly smaller share of the pie in 2023. Following the events of 2022 that sent shockwaves through the broader cryptoasset ecosystem, the market will ultimately struggle to price the risks of undercollateralized lending. Accordingly, we anticipate uncollateralized lending to fall from 50% of RWA TVL at the start of the year to 25% come 2024.

Fig. 4: Uncollateralized Lending as Percentage of RWA TVL 30D MA

Prediction #4: Stablecoin Daily Active Addresses to Double to 300K

As the cryptoasset market rebounds in 2023, RWA-back stablecoins gain prominence, and stablecoins further integrate into global commerce, as exemplified by stablecoin issuer Circle announcing Apple Pay support for USDC in November 2022, we anticipate that stablecoin daily active addresses will experience their next leg of growth.² More specifically, we expect activity to more than double and surpass 300,000 daily active addresses.

Fig. 5: Stablecoin Daily Active Addresses 30D MA vs. Projected

Prediction #5: Total Stablecoin Market Cap to More Than Double and Surpass $300B

Much like stablecoin daily active addresses doubling and hitting new all-time highs, we expect the market cap of stablecoins to more than double from $150B at the start of the year and soar past $300B in 2023. Such a jump would be consistent with the growth witnessed over the past several years. For instance, the total stablecoin market cap exploded from $28B to nearly $190B, a +578% increase, prior to the events of 2022 that led to a wave of stablecoin redemptions.

Fig. 6: Stablecoin Market Cap vs. Projected

Prediction #6: BUSD Daily Active Addresses Surpass DAI and Hit an All-Time High

Despite Maker’s DAI having long been a widely used stablecoin within the world of DeFi, since hitting an all-time high of more than 10,000 daily active addresses in January 2021, DAI usage has trended lower. For all of 2022, DAI daily active addresses hovered around 3,000 and 5,000. This compares to BUSD daily active addresses soaring from 1,000 to more than 2,500 over the same period.

BUSD’s jump in usage can be explained by the stablecoin continuing to become more integrated into the cryptoasset industry as Binance innovates and continues to prove to the crypto industry that it’s a force to be reckoned with. That said, we expected BUSD daily active addresses to flip DAI daily active addresses as BUSD becomes further integrated into the cryptoasset industry and Binance reclaims market share lost to FTX.

Fig. 7: BUSD & DAI Daily Active Addresses 30D MA

Prediction #7: USDC and BUSD Market Cap to Flip USDT

Assuming USDC sees further adoption inside and outside of crypto and BUSD continues to gain momentum as Binance regains market share, we expect both stablecoins to flip Tether’s USDT stablecoin in market capitalization in 2023. Since 2021, USDC has continued to narrow the gap with USDT thanks to its ability to further integrate into the cryptoasset ecosystem and its desire to remain transparent. At the start of 2021, USDT’s market cap was more than 4.3x larger than USDC before shrinking to 0.5x as of January 1, 2023.

Fig. 8: Stablecoin Market Caps

Concerning BUSD, we believe that despite having a similar risk profile as USDT, BUSD’s limited transparency will not hinder its growth in the same way as Tether. Aside from Binance regaining market share, the growth in BUSD’s market cap and active addresses over the years suggest that BUSD will climb to a new all-time high in 2023 and surpass USDT as the stablecoin’s first-to-market competitive advantage dwindles and growth slows further.

Prediction #8: 75% Of MakerDAO’s Revenue to Come From RWA, But Make Up Less Than 20% of Balance Sheet

In 2022, MakerDAO, the decentralized autonomous organization behind the Maker protocol on Ethereum, made a series of moves to increase their exposure to RWA to earn a yield on their assets.³ As a result, RWA went from making up less than 1% of MakerDAO’s balance sheet and revenue at the start of 2022 to less than 13% of MakerDAO’s balance sheet but generating 57% of MakerDAO’s revenue. Between MakerDAO’s success in allocating to RWA and several new offerings coming to market, we expect this disparity to only widen in 2023.⁴ As such, we predict less than 20% of MakerDAO’s balance sheet will be allocated to RWA but will make up more than 75% of MakerDAO’s revenue.

Fig. 9: RWA as Percentage of RWA Balance Sheet and Revenue

Prediction #9: Major Financial Institution(s) Will Move Into the RWA and/or Stablecoin Industry

Though we expect 2023 to be one of the biggest for RWA and stablecoins, 2022 was also a notable year. Several developments proved that both industries are on the radar of traditional financial institutions and market participants. Over the past six months alone, the following noteworthy events took place:

A BNY Mellon survey of more than 270 institutional investors found that “91% of respondents expressed interest in investing in tokenized products.”⁵

The World Economic Forum (WEF) stated, “The last remaining challenge of a digital economy is to put real-world assets onto the internet to achieve a computable economy.”⁶

BlackRock CEO Larry Fink said, “The next generation for markets, the next generation for securities, will be tokenization of securities.”⁷

Coinbase’s 2023 Crypto Market Outlook report stated that institutional entities will seek to use permissioned DeFi platforms and will drive innovations in RWA.⁸

Binance Research and Messari cite RWA as a key theme for 2023.⁹ ¹⁰

A panel of blockchain industry personalities at the World Economic Forum (WEF) states the economy will become increasingly tokenized in the future.¹¹

Executives at fund manager VanEck stated they’re bullish on security tokenization accelerating in 2023 and believe sovereign institutions could be a primary driver of a projected bitcoin price increase in the second half of next year.¹²

As such, we predict that 2023 will not only be accompanied by more similar kinds of outspoken support but at least one major financial institution moving into the RWA and/or stablecoin industry. Such will mark the start of what many believe to be an inevitable transition of TradFi integrating into DeFi.

Prediction #10: New Stablecoins Will Emerge That Steal Market Share and Prove to Be Superior

As outlined in our The Stablecoin Trilemma report, the days are limited for stablecoins that are only sufficiently decentralized, capital efficient, and stable. That is to say, to remain competitive going forward, stablecoins also need to be scalable and have utility. For this reason, along with the fact that the stablecoin market is ripe with opportunity, we expect new stablecoins to come to market in 2023 that ultimately steal market share and prove superior in several ways. The emergence of said stablecoins will also confirm that RWA is a multi-trillion-dollar opportunity.

Conclusion

As one can see, 2023 is set to be one of, if not the biggest, years for RWA and stablecoins. Although we anticipate not all areas of RWA and stablecoins to see as much growth as others, we expect 2023 to conclude with a series of new all-time highs having been achieved and new industry players in the market. So, while there’s no telling what 2023 brings, it’s safe to say that the future for RWA and stablecoins have never been brighter, and now is the time to pay close attention.

Sources

https://medium.com/centrifuge/blocktower-credit-and-makerdao-to-fund-220-million-of-real-world-assets-through-centrifuge-b52d0fab0fee

https://www.circle.com/blog/apple-pay-is-now-available-on-circle

https://vote.makerdao.com/executive/template-executive-vote-onboarding-real-world-asset-vaults-july-29-2022

https://dune.com/SebVentures/maker---accounting_1

https://www.bnymellon.com/us/en/insights/all-insights/digital-asset-survey.html

https://www.weforum.org/agenda/2022/11/web3-s-programmable-commerce-layer-will-transform-the-world-economy/

https://decrypt.co/116145/blackrock-ceo-says-next-generationmarkets-is-tokenization

https://coinbase.bynder.com/m/4888c95272561d10/original/2023-Crypto-Market-Outlook.pdf

https://research.binance.com/en/analysis/full-year-2022

https://www.slideshare.net/loukerner2/messaris-crypto-thesesfor2023

https://www.weforum.org/events/world-economic-forum-annual-meeting-2023/sessions/tokenized-economies-coming-alive

https://blockworks.co/news/vaneck-execs-predict-tokenization-trend-in-2023

How To Reach Us

Did you enjoy this report and want to leave feedback? Please participate in a brief survey and let us know what you think!

Have questions or want to learn more? Feel free to contact us at [email protected] and/or visit us at Fortunafi.com.

Be sure to follow us on Twitter and subscribe to our Real World Insights newsletter to stay up to date with the latest Fortunafi developments and releases!