- Fortunafi's Real World Insights

- Posts

- Fortunafi's 3Q2023 State of the Industry Report (RWA & Stablecoins)

Fortunafi's 3Q2023 State of the Industry Report (RWA & Stablecoins)

What happened in the world of Real World Assets & stablecoins in 3Q2023

An optimistic start to 3Q2023 grew faint despite the cryptoasset industry scoring monumental wins against U.S. regulators. Still, not all pockets of crypto saw momentum fade in 3Q2023, including Real World Assets and Stablecoins.

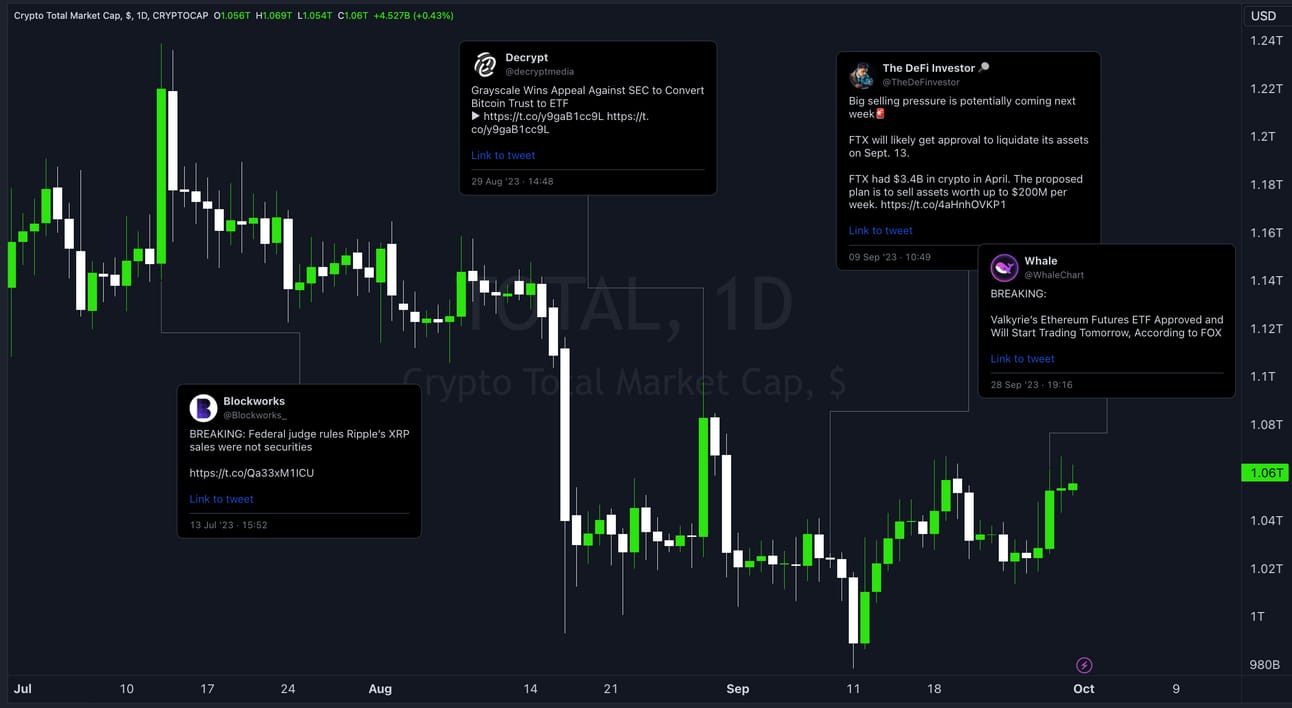

When it looked like summer seasonality was ending, and the bulls were on the brink of reclaiming control, a loss of momentum and market-wide fear dragged prices lower. 3Q started on a high note, with late-2Q optimism bleeding over and getting super-charged later in Jul. after a U.S. judge ruled that Ripple Labs didn’t violate federal securities law by selling its XRP token on public exchanges.¹ The news came just a month after unprecedented enforcement actions from the SEC that claimed exchanges were operating as unregistered brokers dealing in securities, which led to some industry players delisting tokens and a market-wide sell-off. The ruling in favor of Ripple Labs convinced many in the ecosystem that XRP and other cryptoassets are not securities. Accordingly, the market posted one of its biggest daily returns (+6.3%) since Sept. 2017.

Crypto Total Market Cap (1D)

After hitting an intra-month high on Aug. 9, 2023, BTC fell to a 2-month low the following week. The drop coincided with BTC open interest dropping -$3.5B in the largest liquidation since FTX collapsed.² With bears under control, the market struggled to rebound even in the face of a federal appeals court ruling that the SEC must “vacate” its rejection of Grayscale’s bid to convert its Bitcoin Trust into an ETF.³ As Sept. rolled around, further downside came after a court ruled on Sept. 13, 2023, that FTX could begin liquidating billions in cryptoassets to pay back creditors.⁴ While the market bounced into quarter-end on hopes of a favorable spot BTC ETF and the approval of Valkyrie’s ETH futures ETF, 3Q stayed true to being a seasonally underwhelming quarter.

Notwithstanding summer doldrums, downside price action, and unsustained optimism from favorable court rulings, the broader Real World Assets (RWA) and stablecoins sectors notched yet another favorable quarter. More specifically, a broader rise in RWA total value locked (TVL), the entrance of new protocols, and promising experimentation reinforced market participants’ confidence in the sector. Meanwhile, the launch of new stablecoins, mixed support from governments, and a market-share shake-up caught the market by surprise.

After reading this report, you can expect to understand better where industry sentiment lies, the most notable developments of 3Q2023 for RWA and stablecoins, what to expect in the quarters ahead, what Fortunafi has been up to, and where we’re headed next.

Want To Read The Full Report?

Every quarter, we break down what happened in RWA and stablecoins so you can stay informed and educated. Not only that, but we also provide a detailed outlook of what to expect in light of ongoing market developments.

Topics Covered:

Crypto, RWA, & DeFi Sentiment

The Entrance of New RWA Players

Governments & Institutions Dabbling In RWA

Tokenization Experimentation Ramping Up

The Rise of New & Existing Stablecoins

Proof Stablecoins Are Going Mainstream

RWA’s Next Growth Driver: DAO Treasuries

Why Better Days Are Ahead for ALL of Crypto

Disclaimer: The information contained herein is general information, intended for educational purposes only, and is not intended to constitute legal, tax, accounting, or investment advice. Information, opinions, and views are solely of Fortunafi, and none of the information contained should be used as the basis for any investment decisions. To ensure suitability, contact a licensed investment professional when making any investment decisions and do your own research.